Market Outlook

March 16, 2018

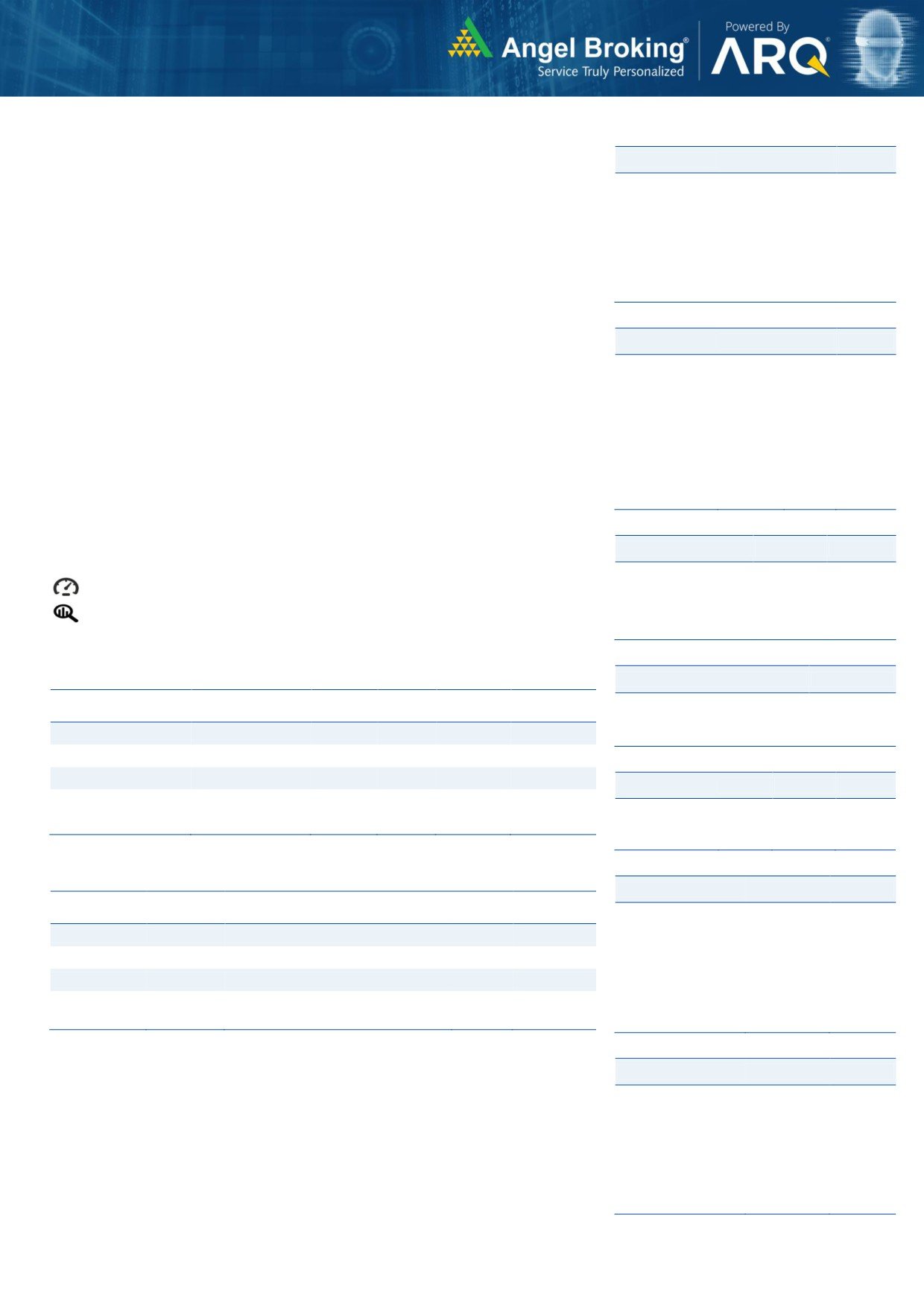

Market Cues

Domestic Indices

Chg (%)

(Pts)

(Close)

Indian markets are likely to open negative tracking global indices and SGX Nifty.

BSE Sensex

(0.4)

(150)

33,686

U.S. stocks showed a lack of direction over the course of the trading day. The major

Nifty

(0.5)

(51)

10,360

averages spent the day bouncing back and forth across the unchanged line before

Mid Cap

0.5

80

16,395

closing mixed. The Dow Jones climbed to 0.5% to close at 24,874. The NASDAQ

Small Cap

0.8

142

17,755

dropped down by 0.2% to close at 7,482.

Bankex

(0.5)

(138)

27,923

U.K. stocks finished with a slight gain, helped by advances for supermarket giant

Tesco PLC after a ratings upgrade. The FTSE 100 was up by 0.1% to end at 7,140.

Global Indices

Chg (%)

(Pts)

(Close)

On domestic front, Indian shares ended lower, with investors indulging in some brisk

Dow Jones

0.5

116

24,874

selling past mid afternoon amid lingering concerns over the impact of a trade war

Nasdaq

(0.2)

(15)

7,482

on the global economy and on mostly weak cues from the U.S. and Asian markets.

FTSE

0.1

7

7,140

The BSE Sensex ended down by 0.4% at 33,686.

Nikkei

(0.2)

(53)

21,751

News Analysis

Hang Seng

(0.3)

(98)

31,443

TN govt to focus on aerospace, defence sectors to get Rs 100bn investment

Shanghai Com

0.2

5

3,297

Detailed analysis on Pg2

Advances / Declines

BSE

NSE

Investor’s Ready Reckoner

Advances

1,642

1,100

Key Domestic & Global Indicators

Declines

1,065

674

Stock Watch: Latest investment recommendations on 150+ stocks

Unchanged

157

77

Refer Pg5 onwards

Top Picks

Volumes (` Cr)

CMP

Target

Upside

Company

Sector

Rating

BSE

5,282

(`)

(`)

(%)

Blue Star

Capital Goods

Accumulate

800

867

8.3

NSE

28,279

Dewan Housing FinanceFinancials

Buy

515

720

39.7

Century Plyboards

Forest Product

Buy

331

400

20.8

Net Inflows (` Cr)

Net

Mtd

Ytd

Navkar Corporation

Others

Buy

168

265

58.0

FII

(50)

8,291

8,783

KEI Industries

Capital Goods

Buy

373

436

16.9

*MFs

(273)

(455)

24,750

More Top Picks on Pg4

Key Upcoming Events

Top Gainers

Price (`)

Chg (%)

Previous

Consensus

Date

Region

Event Description

Reading

Expectations

MMTC

62

20.0

Mar 16

India

Exports YoY%

9.10

JPASSOCIAT

19

17.5

Mar 16

US

Industrial Production

(0.05)

0.40

CENTRALBK

87

15.6

Mar 16

Euro Zone Euro-Zone Consumer Confidence

0.10

HINDCOPPER

74

13.1

Mar 16

US

Housing Starts

1,326.00

1,290.00

Mar 16

US

Building permits

1,377.00

1,320.00

FRETAIL

558

8.8

More Events on Pg7

Top Losers

Price (`)

Chg (%)

HDIL

43

(3.4)

CANFINHOME

532

(3.1)

KPRMILL

680

(2.8)

DISHTV

69

(2.7)

IOC

192

(2.7)

As on March 15, 2018

Market Outlook

March 16, 2018

News Analysis

TN govt to focus on aerospace, defence sectors to get Rs 100bn

investment

The Tamil Nadu government will give special emphasis to establish an Aero Space

Park and a defence manufacturing corridor in the state, which is expected to

attract around Rs 100 billion investment. The state government will continue to

offer structured package assistance for large investments on a case by case basis

depending on the investment level, generation of employment opportunities and

other parameters.

The State government is also expected to come out with policies related to Aero

Space and defence manufacturing in the near future. The facilitator SIPCOT has

already created a land-bank of 5,023 acres to promote new industrial units and it

will develop additional land-bank of 9,030 acres to allot sufficient land to new

investors

Economic and Political News

Tamil Nadu govt projects Rs 174.90 billion revenue deficit in 2018-19

Hindustan Unilever's GST benefit deposit offer to Government touches Rs

1.55bn

Government released Rs 125bn to Andhra as special assistance

Corporate News

Air India mopped up Rs 5.43bn from asset monetisation in five years

Tata's Chief Ethics Officer Mukund Rajan quits for entrepreneurial pursuits

Infosys to open fourth innovation hub in Connecticut, to hire 1,000 by 2022

Market Outlook

March 16, 2018

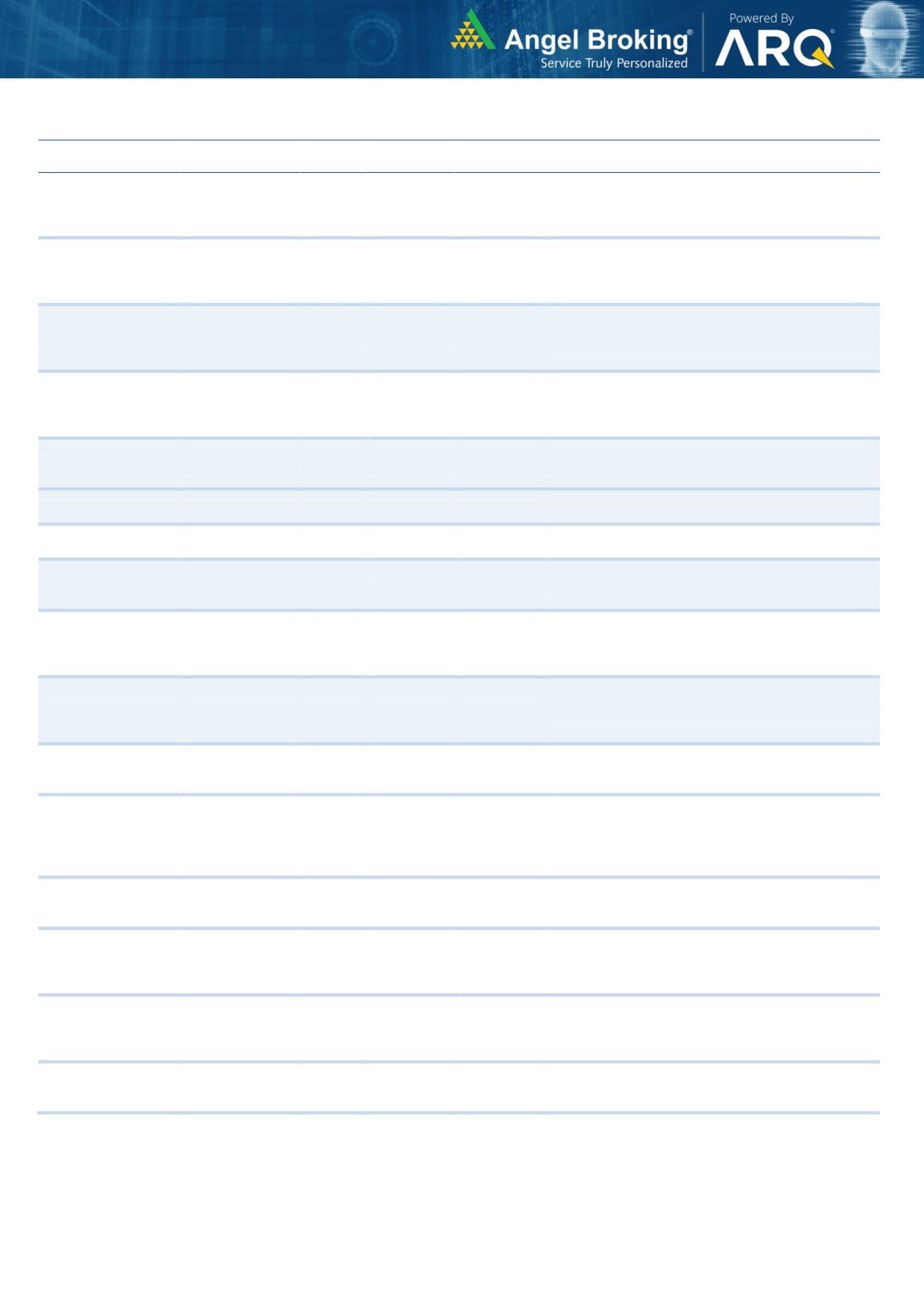

Top Picks

Market Cap

CMP

Target

Upside

Company

Rationale

(` Cr)

(`)

(`)

(%)

Strong growth in domestic business due to its

leadership in acute therapeutic segment. Alkem

Alkem Laboratories

26,378

2,206

2,441

10.6

expects to launch more products in USA, which bodes

for its international business.

Favorable outlook for the AC industry to augur well for

Cooling products business which is out pacing the

Blue Star

7,682

800

867

8.3

market growth. EMPPAC division's profitability to

improve once operating environment turns around.

With a focus on the low and medium income (LMI)

consumer segment, the company has increased its

Dewan Housing Finance

16,168

515

720

39.7

presence in tier-II & III cities where the growth

opportunity is immense.

Well capitalized with CAR of

18.1% which gives

sufficient room to grow asset base. Faster resolution of

ICICI Bank

1,93,695

301

416

38.0

NPA would reduce provision cost, which would help to

report better ROE.

High order book execution in EPC segment, rising B2C

KEI Industries

2,923

373

436

16.9

sales and higher exports to boost the revenues and

profitability

Expected to benefit from the lower capex requirement

Music Broadcast Limited

2,125

372

475

27.6

and 15 year long radio broadcast licensing.

Massive capacity expansion along with rail advantage

Navkar Corporation

2,524

168

265

58.0

at ICD as well CFS augur well for the company

Strong brands and distribution network would boost

Siyaram Silk Mills

2,990

638

851

33.4

growth going ahead. Stock currently trades at an

inexpensive valuation.

Market leadership in Hindi news genre and no. 2

viewership ranking in English news genre, exit from the

TV Today Network

3,054

512

537

5.1

radio business, and anticipated growth in ad spends

by corporate to benefit the stock.

After GST, the company is expected to see higher

volumes along with improving product mix. The

Maruti

2,66,824

8,833

10,619

20.2

Gujarat plant will also enable higher operating

leverage which will be margin accretive.

We expect loan book to grow at 24.3% over next two

GIC Housing

2,138

397

655

64.9

year; change in borrowing mix will help in NIM

improvement

We expect CPIL to report net Revenue/PAT CAGR of

~17%/16% over FY2017-20E mainly due to healthy

Century Plyboards

7,357

331

400

20.8

growth in plywood & lamination business, forayed into

MDF & Particle boards on back of strong brand &

distribution network.

We expect sales/PAT to grow at 13.5%/20% over next

LT Foods

2,813

88

128

45.5

two years on the back of strong distribution network &

addition of new products in portfolio.

Third largest brand play in luggage segment Increased

product offerings and improving distribution network is

Safari Industries

1,184

532

650

22.1

leading to strong growth in business. Likely to post

robust growth for next 3-4 years

We expect HSIL to report PAT CAGR of ~15% over

FY2017-20E owing to better improvement in operating

HSIL Ltd

2,920

404

510

26.3

margin due price hike in container glass segment,

turnaround in consumer business.

We expect financialisation of savings and increasing

Aditya Birla Capital

33728

150

218

41.5

penetration in Insurance & Mutual fund would ensure

steady growth.

Source: Company, Angel Research

Market Outlook

March 16, 2018

Fundamental Call

Market Cap

CMP

Target

Upside

Company

Rationale

(` Cr)

(`)

(`)

(%)

CCL is likely to maintain the strong growth trajectory

CCL Products

3,912

294

360

22.4

over FY18-20 backed by capacity expansion and new

geographical foray

We forecast Nilkamal to report top-line CAGR of ~9%

to `2,635cr over FY17-20E on the back of healthy

Nilkamal

2,499

1,675

2,178

30.0

demand growth in plastic division. On the bottom-line

front, we estimate ~10% CAGR to `162cr owing to

improvement in volumes.

We expect sales/PAT to grow at 9%/14% over next two

years on the back of healthy demand growth in

Shreyans Industries

213

154

247

60.0

printing. Further, China had banned making paper

from waste pulp which would benefit Indian paper

companies.

The prism has diversified exposure in the different

segment such as Cement, Tile & ready mix concrete.

Prism Cement

5,834

116

160

38.1

Thus we believe, PCL is in the right place to capture

ongoing government spending on affordable housing

and infrastructure projects.

Elantas Beck India is the Indian market leader in liquid

insulation segment used in electrical equipments like

Elantas Beck India Ltd

1,610

2,031

2,500

23.1

motors, transformers etc. It derives demand from

several industries which are expected to register 10%+

CAGR in demand in the coming years.

RPL to report healthy top-line CAGR of ~13% over

FY17-20E on the back of healthy demand in printing &

Ruchira Papers Ltd.

401

179

244

36.5

writing paper segments. On the bottom-line front, we

estimate ~16% CAGR over FY17-20E owing to strong

improvement in operating performance.

Greenply Industries Ltd (GIL) manufactures plywood &

allied products and medium density fibreboards

(MDF). GIL to report net revenue CAGR of ~14% to

Greenply Industries

4,107

335

395

17.9

~`2,478cr over FY2017-20E mainly due to healthy

growth in plywood & lamination business on the back

of strong brand and distribution network

Source: Company, Angel Research

Market Outlook

March 16, 2018

Key Upcoming Events

Global economic events release calendar

Bloomberg Data

Date

Time Country

Event Description

Unit

Period

Last Reported

Estimated

Mar 16, 2018

India

Exports YoY%

% Change

Feb

9.10

6:45 PMUS

Industrial Production

%

Feb

(0.05)

0.40

8:30 PMEuro Zone

Euro-Zone Consumer Confidence

Value

Mar A

0.10

6:00 PMUS

Housing Starts

Thousands

Feb

1,326.00

1,290.00

Mar 20, 2018

6:00 PMUS

Building permits

Thousands

Feb

1,377.00

1,320.00

3:00 PMUK

CPI (YoY)

% Change

Feb

3.00

Mar 21, 2018

7:30 PMUS

Existing home sales

Million

Feb

5.38

5.46

3:00 PMUK

Jobless claims change

% Change

Feb

(7.20)

11:30 PMUS

FOMC rate decision

%

Mar 21

1.50

1.75

Mar 22, 2018

2:00 PMGermany

PMI Services

Value

Mar P

55.30

2:00 PMGermany

PMI Manufacturing

Value

Mar P

60.60

5:30 PMUK

BOE Announces rates

% Ratio

Mar 22

0.50

Mar 23, 2018

7:30 PMUS

New home sales

Thousands

Feb

593.00

620.00

Mar 27, 2018

7:30 PMUS

Consumer Confidence

S.A./ 1985=100

Mar

130.80

Mar 28, 2018

1:25 PMGermany

Unemployment change (000's)

Thousands

Mar

(22.00)

Mar 29, 2018

6:00 PMUS

GDP Qoq (Annualised)

% Change

4Q T

2.50

2:00 PMUK

GDP (YoY)

% Change

4Q F

1.40

Mar 31, 2018

6:30 AMChina

PMI Manufacturing

Value

Mar

50.30

Apr 03, 2018

2:00 PMUK

PMI Manufacturing

Value

Mar

55.20

Apr 05, 2018

2:30 PMIndia

RBI Reverse Repo rate

%

Apr 5

5.75

2:30 PMIndia

RBI Repo rate

%

Apr 5

6.00

2:30 PMIndia

RBI Cash Reserve ratio

%

Apr 5

4.00

Apr 06, 2018

6:00 PMUS

Change in Nonfarm payrolls

Thousands

Mar

313.00

6:00 PMUS

Unnemployment rate

%

Mar

4.10

Source: Bloomberg, Angel Research

Market Outlook

March 16, 2018

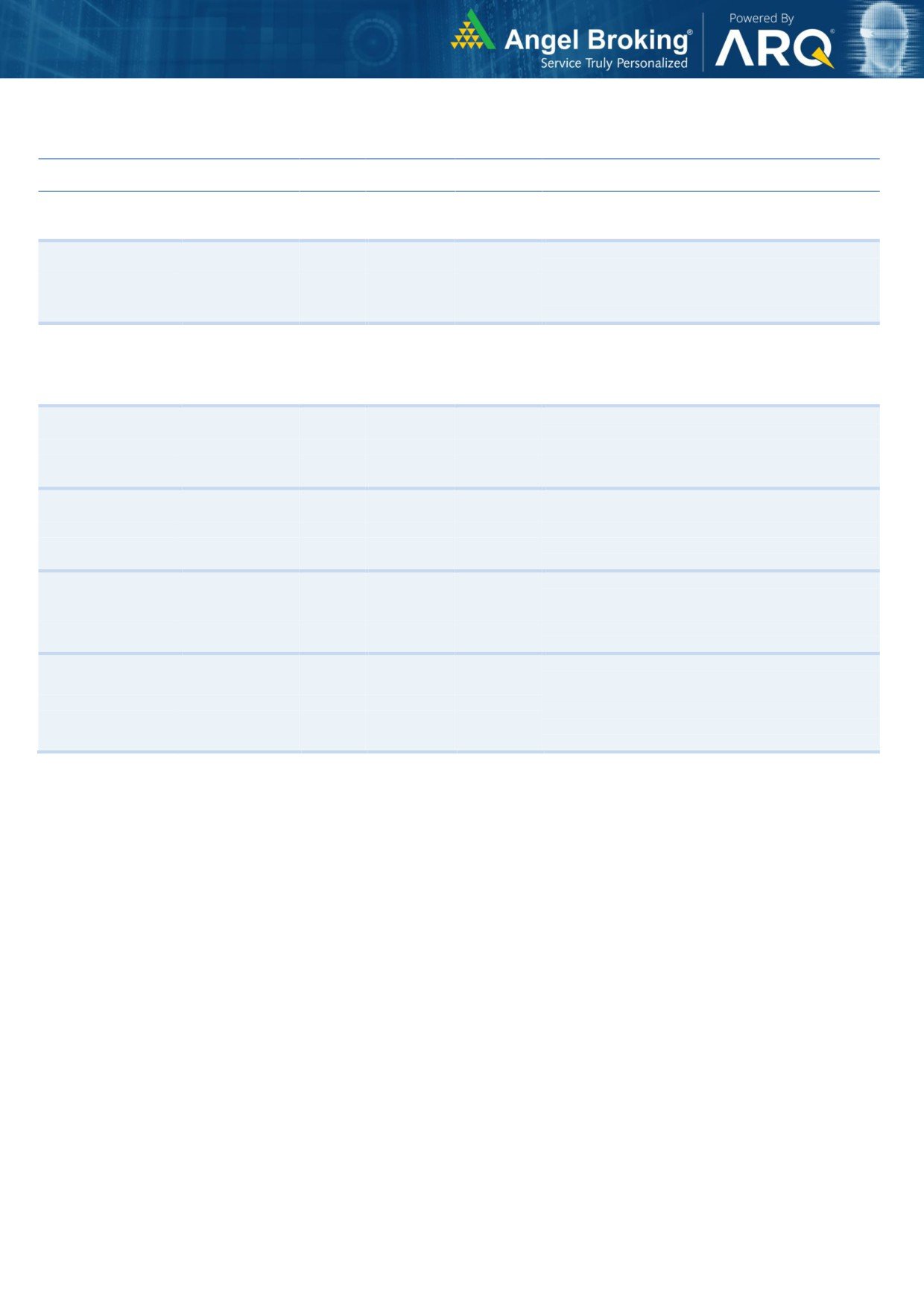

Macro watch

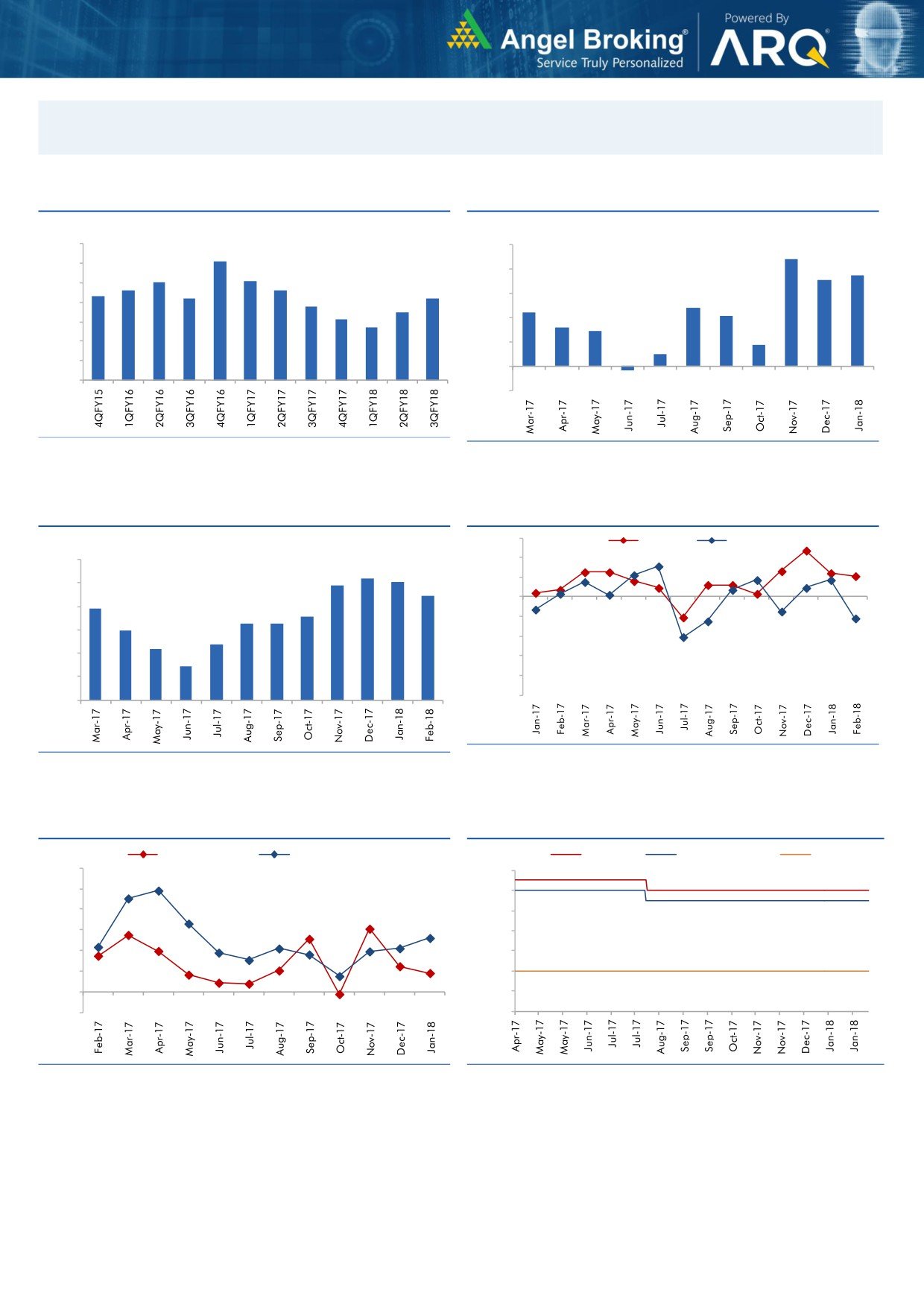

Exhibit 1: Quarterly GDP trends

Exhibit 2: IIP trends

(%)

(%)

10.0

10.0

9.1

8.8

9.0

7.5

8.0

8.1

8.0

7.1

7.6

7.6

8.0

7.3

7.2

7.2

6.8

6.0

4.8

7.0

6.5

4.4

6.1

4.1

5.7

4.0

3.2

2.9

6.0

1.8

5.0

2.0

1.0

4.0

-

3.0

(0.3)

(2.0)

Source: CSO, Angel Research

Source: MOSPI, Angel Research

Exhibit 3: Monthly CPI inflation trends

Exhibit 4: Manufacturing and services PMI

56.0

Mfg. PMI

Services PMI

(%)

6.0

54.0

5.2

5.1

4.9

52.0

5.0

4.4

3.9

50.0

4.0

3.6

3.3

3.3

3.0

48.0

3.0

2.4

2.2

46.0

2.0

1.5

44.0

1.0

42.0

40.0

-

Source: Market, Angel Research; Note: Level above 50 indicates expansion

Source: MOSPI, Angel Research

Exhibit 5: Exports and imports growth trends

Exhibit 6: Key policy rates

(%)

Exports yoy growth

Imports yoy growth

(%)

Repo rate

Reverse Repo rate

CRR

60.0

6.50

50.0

6.00

40.0

5.50

30.0

5.00

20.0

4.50

10.0

4.00

0.0

3.50

(10.0)

3.00

Source: Bloomberg, Angel Research

Source: RBI, Angel Research

Market Outlook

March 16, 2018

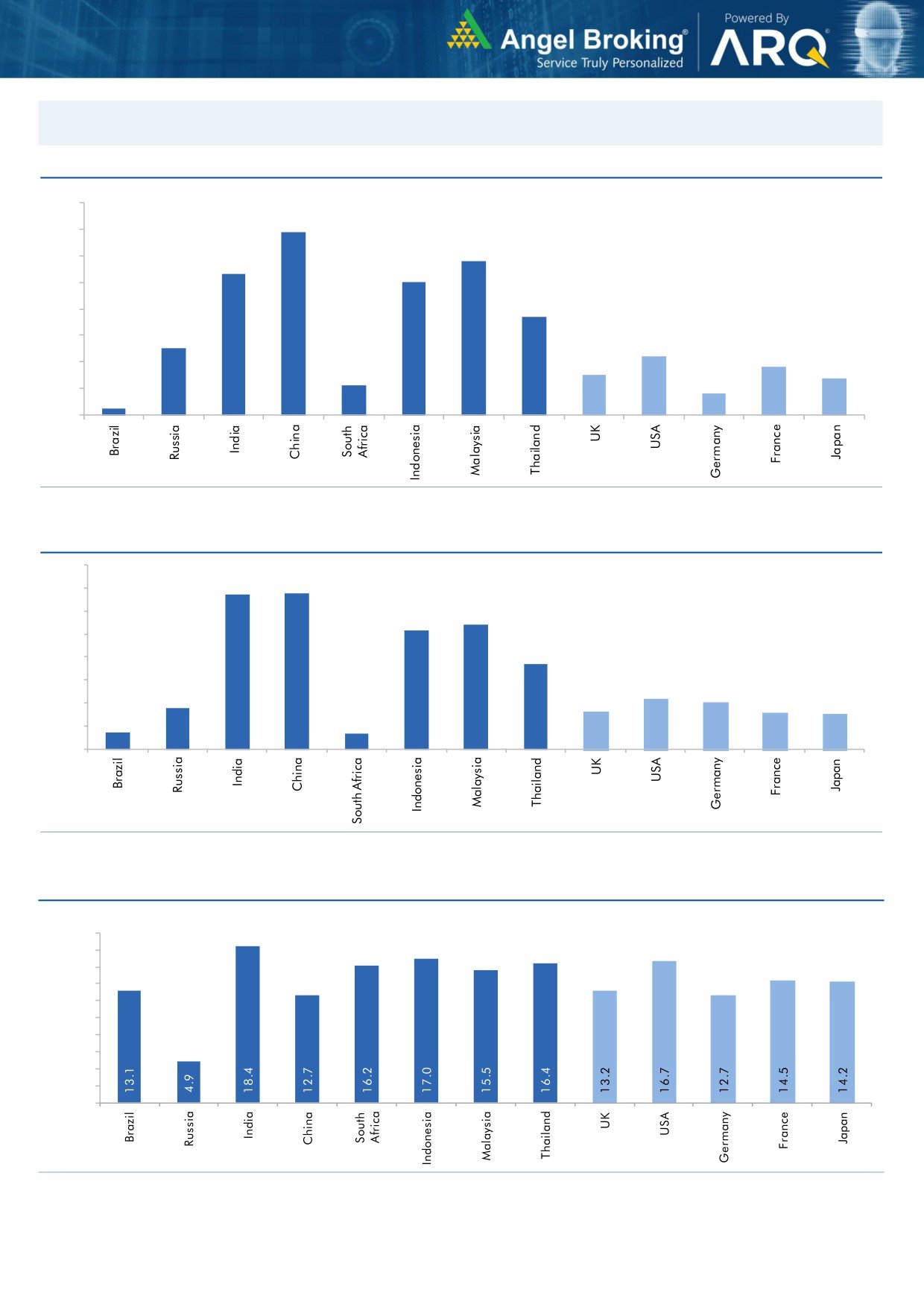

Global watch

Exhibit 1: Latest quarterly GDP Growth (%, yoy) across select developing and developed countries

(%)

8.0

6.9

7.0

5.8

6.0

5.3

5.0

5.0

1.1

3.7

4.0

2.5

3.0

2.2

1.8

2.0

1.5

1.4

0.8

1.0

0.3

-

Source: Bloomberg, Angel Research

Exhibit 2: 2017 GDP Growth projection by IMF (%, yoy) across select developing and developed countries

(%)

6.7

6.8

7.0

6.0

5.4

5.2

5.0

3.7

4.0

3.0

1.8

2.2

2.0

1.7

1.6

2.0

0.7

1.5

0.7

1.0

-

Source: IMF, Angel Research

Exhibit 3: One year forward P-E ratio across select developing and developed countries

(x)

20.0

18.0

16.0

14.0

12.0

10.0

8.0

6.0

4.0

2.0

-

Source: IMF, Angel Research

Market Outlook

March 16, 2018

Exhibit 4: Relative performance of indices across globe

Returns (%)

Country

Name of index

Closing price

1M

3M

1YR

Brazil

Bovespa

84,928

5.0

17.2

31.2

Russia

Micex

2,272

3.4

8.0

14.0

India

Nifty

10,360

(0.9)

0.4

16.0

China

Shanghai Composite

3,291

(0.4)

0.2

1.7

South Africa

Top 40

51,613

2.4

0.6

15.6

Mexico

Mexbol

47,817

(0.2)

0.2

0.7

Indonesia

LQ45

1,039

(7.2)

1.1

15.3

Malaysia

KLCI

1,845

0.8

7.2

6.7

Thailand

SET 50

1,195

2.7

8.5

22.6

USA

Dow Jones

24,874

1.1

2.0

18.8

UK

FTSE

7,140

(0.4)

(4.8)

(3.8)

Japan

Nikkei

21,804

2.6

(4.4)

13.2

Germany

DAX

12,346

1.2

(6.4)

2.2

France

CAC

5,267

3.1

(2.9)

5.3

Source: Bloomberg, Angel Research p68in4